One World. One Company. One Donation.

When the word sustainability is mentioned in conversation, not everyone has the same understanding of what it means. When you google the term, two definitions are provided:

- the ability to be maintained at a certain rate or level.

- avoidance of the depletion of natural resources in order to maintain an ecological balance.

No matter how the word fits or does not fit into your life, it is a common buzzword that people, companies and governments are incorporating in their daily lives. Whether or not you agree and participate, sustainability is all around you.

Do you compost or have recycling picked up at your home or office?

Have you ever seen a street lamp replaced?

Have you ever had a 10 minute oil change?

Are you signed up for paperless billing with your phone, utilities, car, etc.?

In working for a local utility, sustainability has not only been pushed to “maintain an ecological balance” but also to keep utility rates down for our customers. Utilities, like Motel 6, like to keep the light on for you. Lights go out and need to be replaced. Bulbs should not go to the dump for various reasons but mainly because of the mercury in them. Most bulbs are made up of glass, mercury and metal. My utility, crushes these bulbs onsite, then ships them off with a waste contractor who recycles them by sorting the glass, metal and mercury then finding ways to reuse all of these products.

Do you work with a company that requires travel or use some sort of transportation to get to work, that vehicle probably gets a routine oil change. Oil is often recycled through a filtering and refining process which then allows the same oil to be reused. This process can happen an infinite number of times.

Paperless billing, is a process where companies are reducing their mail costs while being sustainable. If you were to just take the employees at the utility I work for who have signed up for paperless billing, this initiative has saved over a ton of paper per year. Just think of how much paper would be saved if 5% of the total service area moved to paperless billing.

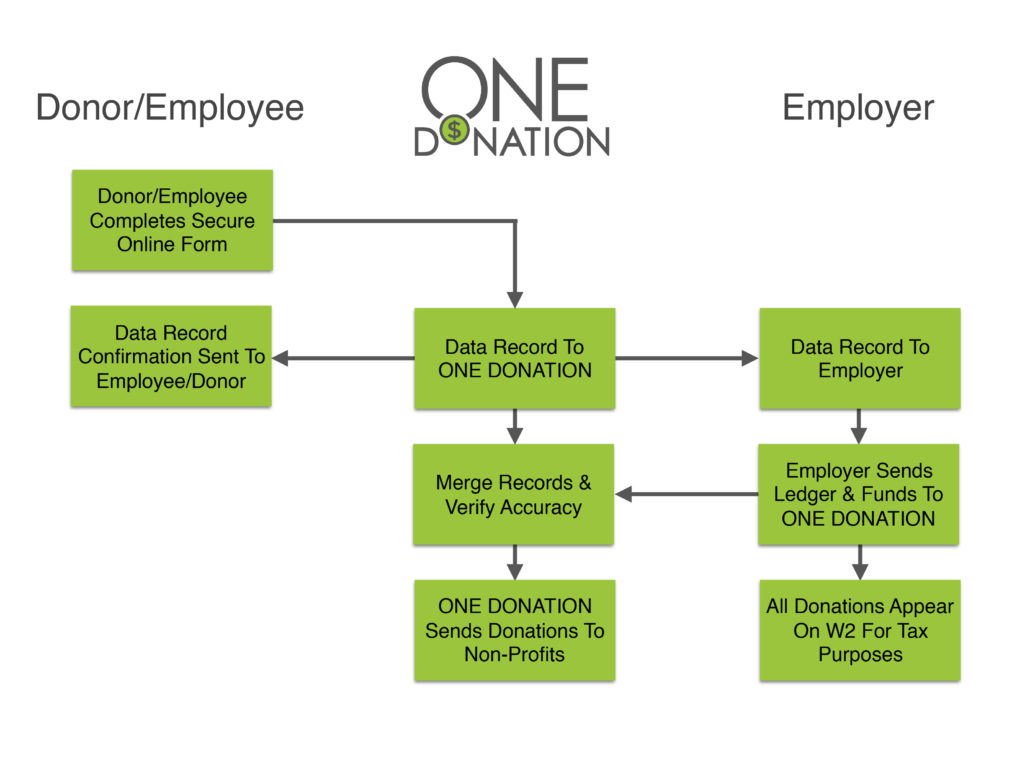

Years ago I heard on the radio that millennials were more interested in getting information fast and at their fingertips than protecting their identity. I, on the other hand, really want both. One Donation helps me with this by providing a secure app that I can send a donation to the charity of my choice. Soon, One Donation is about to add a platform for payroll deduction for companies to donate to their own selected charities. This process will incorporate a paperless signup (wow sustainable) for companies and utilize HIPPA compliant document exchange to keep employee’s information protected.